Summary of Corporate Governance

Basic Concept

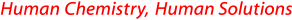

Based on the basic mission of the sustainable improvement of shareholder value, the Teijin Group has been strengthening its governance to fulfill its responsibilities to various stakeholders. The basics of corporate governance are improving transparency, ensuring fairness, accelerating decision-making, and ensuring the independence of monitoring and supervision, and we are working to establish and strengthen an effective corporate governance system through items such as a "Nomination Advisory Committee and Compensation Advisory Committee," an "Advisory Board," a "Board of Directors including Independent Outside Directors and a Corporate Officer System," and a "Board of Statutory Auditors System including Independent Outside Statutory Auditors." Furthermore, the Group has established and published the Teijin Group Corporate Governance Guide, which serves as its guidelines for corporate governance, compliance, and risk management.

Status of Compliance with the Japan's Corporate Governance Code

The Company complies all Principles of the Corporate Governance Code. Please refer to Corporate Governance Report for details.

Basic Policy Concerning Cross-Shareholdings

The Company holds shares of issuing companies that it has determined to be instrumental in increasing its corporate value over the medium to long term, with the objective of maintaining and strengthening transactions with them and promoting business alliances with them. The Board of Directors regularly reviews whether or not it is appropriate to hold shares based on an examination of the purpose of holding the shares and the rationale for holding each individual stock from a medium- to long-term perspective. In these reviews, the Board of Directors takes into account a comprehensive range of factors, including the significance from a strategic standpoint and in terms of business relationship,in addition to weighing dividends, transaction amounts, and other quantitative impacts against the capital cost.After these reviews, those shares for which the purpose of holding has diminished are liquidated, in principle. Through this process, the Company endeavors to reduce cross-shareholdings.

Major Initiatives for Strengthening Governance

| 1999 |

|

|---|---|

| 2003 |

|

| 2012 |

|

| 2015 |

|

| 2021 |

|

| 2022 |

|

| 2023 |

|

- *Applicable from the current Senior Advisor

Organization Structure: Company with Board of Statutory Auditors

The current Companies Act requires the Board of Directors to appropriately carry out two roles: engaging in important business judgment and decision-making, and monitoring and supervising management. To properly fulfill these roles, the Company deems that a corporate governance system based on two core functions--(1) the execution of business led by the internal directors who are corporate officers and (2) management oversight and supervision focused on by outside directors and the Chairperson of the Board of Directors as well as monitoring and auditing carried out by statutory auditors and the Board of Statutory Auditors--is appropriate. Therefore, the Company has decided to continue to be a company with a Board of Statutory Auditors, for the time being.

(As of September 2023)

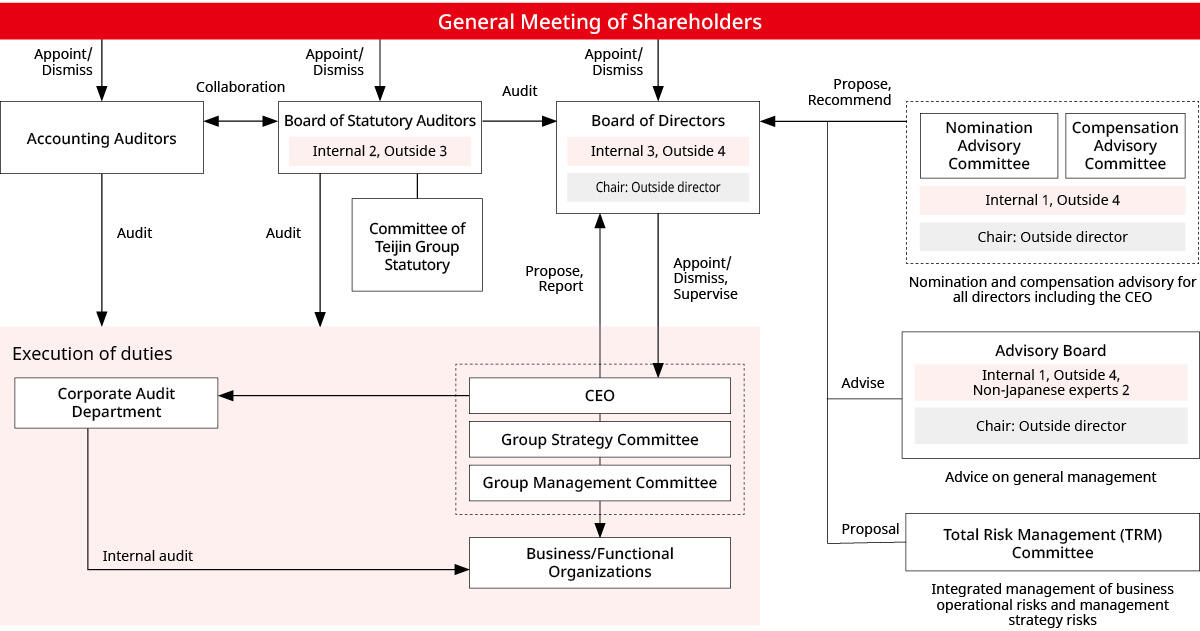

Board of Directors

(As of September 2023)

The Board of Directors meets once a month, in principle, and deliberates and determines/approves important matters, such as Groupwide management policies and plans, as well as any other items required by laws, regulations, and the Company's Articles of Incorporation. The Board is responsible for ensuring accountability and works to clarify its policies on compliance and how to manage risks surrounding the Company, while also overseeing directors' performance of their duties. To expedite decision-making and clarify accountability of business execution, the Company's Articles of Incorporation set the maximum number of directors at 10, and the Company has introduced a corporate officer system that delegates broad authority to corporate officers. Also, in the Articles of Incorporation, the term of office for directors is set at one year. The chair of the Board of Directors' meetings is selected from the outside directors as part of the Board's efforts to separate monitoring and supervision from business execution.

Board of Directors' Meetings in Fiscal 2022

Number of Meetings Held

13

Main Agenda Items and Discussion Topics

| Management and Business Strategies |

|

|---|---|

| Corporate Governance |

|

| Financial Results, IR, and General Meeting of Shareholders |

|

| Appointment and Compensation of Directors and Officers |

|

Evaluation of Board of Directors' Effectiveness

In order to further ensure the effectiveness and enhance the functions of the Board of Directors, the Company conducts analysis and evaluation of the effectiveness of the entire Board of Directors once a year. The method of the Board of Directors' effectiveness evaluation for fiscal 2022 and an overview of the results are as follows.

Analysis and Evaluation Method

A self-evaluation questionnaire of all directors and statutory auditors (15, including outside directors and outside statutory auditors) where the respondents gave their name was conducted based on the advice of external experts. The evaluation points in the questionnaire were compiled from the following eight fields. Respondents evaluated the questionnaire's 39 questions based on a four-step scale and made comments. In addition, external experts conducted interviews with a total of four directors and statutory auditors based on the questionnaire, aiming to deepen understanding of the management issues to be discussed at the Board of Directors' meetings and to formulate a concrete action plan to address the issues. Based on the results of these questionnaires and interviews, deliberations were held by the Board of Directors regarding the Board's effectiveness as well as issues to be addressed and improvement measures to be implemented.

- 1.Strategy and execution thereof

- 2.Risk and crisis management

- 3.Corporate ethics

- 4.Performance monitoring

- 5.Organization and business restructuring-related transactions

- 6.Management team evaluation, compensation, and succession planning

- 7.Stakeholder dialogue

- 8.Composition and operation of the Board of Directors

Evaluation Results

The results of the Board of Directors' effectiveness evaluation conducted via the aforementioned process found that there was no issue with the current corporate governance system and its implementation, and that the Company's Board of Directors was generally functioning properly and its effectiveness was verified. In addition, the questionnaire results indicated that there was a high ratio of positive evaluations for all items.

Status of Response to Issues Recognized in the Fiscal 2022 Evaluation

- Discussions on Business Creation Utilizing Digital Technologies and Data

At the Board of Directors' meetings held in fiscal 2022, with respect to the use of digital and IT technologies, which is positioned as an important measure for business creation, the progress and issues with themes such as the acquisition and application of advanced technologies, including AI, and the building of a next-generation user environment were reported and discussed. Discussions need to be carried out on the direction of data and digital strategies in the Group overall and on the future investment of resources. The Company also confirmed plans to continue discussions in line with the next medium-term management plan, scheduled to be disclosed in fiscal 2024.

- Discussion on the Business Portfolio

At the Board of Directors' meetings held in fiscal 2022, the Company established specific aims for the long-term vision, which is the vision the Teijin Group aims to achieve in the future, and also held discussions concerning the business portfolio after clarifying the position of existing businesses. Amid these discussions, the Company confirmed it was necessary to broadly review its strategies, mainly the Strategic Focus fields. The Company has temporarily put a halt to Strategic Focus and Profitable Growth field classification, and in fiscal 2023 has decided to focus its efforts on structural reforms in the composites, aramid, and healthcare businesses. The Company plans to continue to carry out discussions concerning the business portfolio, including new growth strategies ahead of the next medium-term management plan, which is scheduled to be disclosed in fiscal 2024.

- Discussions on the Rationale behind the Public Listing of Both Parent and Subsidiary Companies

At the Board of Directors' meetings held in fiscal 2022, the Company discussed the rationality of maintaining the listing of Infocom Corporation and Japan Tissue Engineering Co., Ltd. (J-TEC), which are listed subsidiaries of the Company. From the standpoint of optimizing the corporate value of Infocom and J-TEC, and not just the Group itself, the Company decided it was rational to maintain their listing. It is necessary to regularly confirm the listing of the parent and its subsidiaries. At the Board of Directors' meetings in fiscal 2023, the Company plans to continue to discuss the rationality of maintaining listings on the stock exchange.

- Discussions on Business Continuity Plans Including the Supply Chain

At the Board of Directors' meetings held in fiscal 2022, amid regular reports to the Board by the TRM Committee, which is chaired by the CEO, concerning strategic risk and operational risk, there was a report that the maintenance of customeroriented business continuity plans (BCPs) and business continuity management by business, in particular the Materials Business, was being conducted. The Company confirmed the necessity of clarifying the situation in each business, including the schedule for relevant projects, in order to further promote this initiative. The Company therefore plans to continue to confirm relevant details through discussions.

- Discussions on the Allocation of Management Resources to Human Capital, Intellectual Properties, etc.

At the Board of Directors' meetings held in fiscal 2022, with respect to human capital, activities pertaining to global talent management, corporate culture transformation, and enhancing employee engagement with the Teijin Group were reported and discussed. In addition, as a non-financial indicator for diversity and inclusion, the Company has set goals for fiscal 2030 regarding the number of female directors and non-Japanese directors. In addition, the Company reported and discussed intellectual properties. Taking into account the changing environment surrounding intellectual properties, the Company plans to identify issues that should be addressed and strengthen intellectual properties and the global management of intellectual properties based on the Company's business portfolio. The Company will continue to carry out ongoing discussions on these matters in line with the next medium-term management plan, which is scheduled to be disclosed in fiscal 2024.

Issues Identified in Fiscal 2022 and Measures Going Forward

We identified the following issues as a result of discussions held at Board of Directors' meetings based on the evaluation of effectiveness conducted in fiscal 2022 and will further promote efforts to address them together with discussions on the next medium-term management plan.

- i.Discussions on the business portfolio

- ii.Discussions on the allocation of management resources to human capital, etc., based on (i)

- iii.iii.Discussions on the utilization status and the policy of initiatives of digital technologies and data in business operations, based on (i)

- iv.Discussions on BCPs including the supply chain

- v.Discussions on the rationale behind the public listing of both parent and subsidiary companies

The Company aims to increase the effectiveness of the Board of Directors and further strengthen corporate governance through these measures.

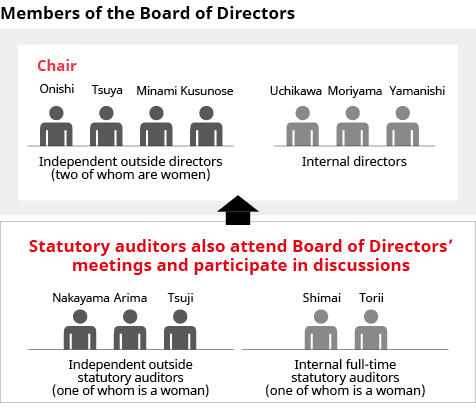

Board of Statutory Auditors / Committee of Teijin Group Statutory Auditors

(As of September 2023)

The Company's statutory auditors possess a high level of expertise and experience in fields such as law, finance, and accounting. These statutory auditors oversee the execution of duties by the directors based on their abundance of expert insight. Furthermore, the Committee of Teijin Group Statutory Auditors, which comprises statutory auditors of Group companies and other members, meets regularly to enhance the effectiveness of Groupwide monitoring and audits.

Board of Statutory Auditors in Fiscal 2022

Basic Policy

- Conduct audits with a focus on the soundness of the Company's business activities

- Assess the situation of increasingly important core overseas businesses

- Emphasize preventative audits through an appropriate approach toward risks

- Collaborate appropriately with the accounting auditors and the Corporate Audit Department

Number of Meetings Held

12

Key Audit Matters

| Auditing Perspective | Key Audit Matters |

|---|---|

| Governance |

|

| Corporate Ethics and Compliance |

|

| Preparation for Operational Risk |

|

| Preparation for Strategic Risk |

|

Skills Matrix

Directors

| Directors | Independent Outside Directors | |||||||

|---|---|---|---|---|---|---|---|---|

| Akimoto Uchikawa | Eiji Ogawa | Naohiko Moriyama | Noboru Yamanishi | Yoichi Suzuki | Masaru Onishi | Masaaki Tsuya | Tamie Minami | |

| Corporate management *1 |

✔ | ✔ | ✔ | ✔ | ||||

| Finance/ Accounting |

✔ | |||||||

| Legal and business risk management |

✔ | ✔ | ✔ | ✔ | ✔ | |||

| Global management |

✔ | ✔ | ✔ | ✔ | ✔ | |||

| Environmental solutions |

✔ | ✔ | ✔ | ✔ | ||||

| Health and safety solutions |

✔ | ✔ | ✔ | ✔ | ||||

| IT/DX/ Innovation *2 |

✔ | ✔ | ✔ | ✔ | ✔ | |||

| Diversity and inclusion |

✔ | ✔ | ||||||

- *1Includes experience with portfolio transformation and structural reforms

- *2Includes experience with manufacturing and quality assurance

(As of September 2023)

Statutory auditors

| Statutory Auditors | Independent Outside Statutory Auditors | ||||

|---|---|---|---|---|---|

| Masanori Shimai | Akio Nakaishi | Hitomi Nakayama | Jun Arima | Koichi Tsuji | |

| Corporate management *1 |

✔ | ||||

| Finance/ Accounting |

✔ | ✔ | |||

| Legal and business risk management |

✔ | ✔ | ✔ | ||

| Global management |

✔ | ✔ | ✔ | ||

| Environmental solutions |

✔ | ✔ | |||

| Health and safety solutions |

✔ | ||||

| IT/DX/ Innovation *2 |

✔ | ||||

| Diversity and inclusion |

✔ | ||||

- *1Includes experience with portfolio transformation and structural reforms

- *2Includes experience with manufacturing and quality assurance

(As of September 2023)

Status of Activities of Directors, Statutory Auditors, and Non-Japanese Experts

| Name | Expected role | Nomination / Compensation Advisory Committee | Advisory Board | Status of meeting attendance in fiscal 2022 | |

|---|---|---|---|---|---|

| Directors | Akimoto Uchikawa | Play the role of CEO in formulating and executing management policies to enhance the corporate value of the Teijin Group | ✔ | ✔ | Attended 13 out of 13 Board of Directors' meetings |

| Eiji Ogawa | Help secure a sound financial base and enhance corporate value by leveraging his knowledge and insight cultivated in finance and accounting fields | Attended 13 out of 13 Board of Directors' meetings | |||

| Naohiko Moriyama | Formulate strategies for creating growth platforms and strengthening management base by leveraging his knowledge and insight cultivated in the Healthcare Business Field and through corporate management and planning | Attended 13 out of 13 Board of Directors' meetings | |||

| Noboru Yamanishi | Promote efforts toward sustainability management, compliance, and risk management by leveraging his knowledge and insight cultivated in the Materials Business Field | Appointed in June 2023 | |||

| Independent Outside Directors |

Yoichi Suzuki | Monitor business management and provide suggestions on business execution based on his experience as a diplomat, wealth of knowledge, and high level of insight from a global perspective | ✔ | ✔ | Attended 13 out of 13 Board of Directors' meetings |

| Masaru Onishi | Monitor business management and provide suggestions on business execution based on his experience as president and chairman of a listed company, abundance of business experience, and high level of insight | ✔ | ✔ | Attended 13 out of 13 Board of Directors' meetings | |

| Masaaki Tsuya | Monitor business management and provide suggestions on business execution based on his experience as CEO and chairman of a listed company, abundance of business experience, and high level of insight | ✔ | ✔ | Attended 10 out of 10 Board of Directors' meetings | |

| Tamie Minami | Monitor business management and provide suggestions on business execution based on her high level of insight from a global perspective and the perspective of diversity and inclusion cultivated through her experience in the healthcare business of a global company | ✔*1 | ✔*1 | Appointed in June 2023 | |

| Statutory Auditors | Masanori Shimai | Monitor overall management and provide advice based on his wealth of knowledge and experience in finance and accounting fields and his deep understanding of the Company's business | Attended 13 out of 13 Board of Directors' meetings Attended 12 out of 12 Board of Statutory Auditors' meetings |

||

| Akio Nakaishi | Monitor overall management and provide advice by leveraging his knowledge of technologies in the Materials Business Field and wealth of practical experience | Attended 13 out of 13 Board of Directors' meetings Attended 12 out of 12 Board of Statutory Auditors' meetings |

|||

| Independent Outside Statutory Auditors | Hitomi Nakayama | Contribute to maintaining and improving the Company's compliance, monitor management, and provide advice based on her insight and experience as a lawyer | Attended 13 out of 13 Board of Directors' meetings Attended 12 out of 12 Board of Statutory Auditors' meetings |

||

| Jun Arima | Contribute to maintaining and improving the Company's compliance, monitor management, and provide advice based on his insight and experience with global environmental issues, etc. | Attended 13 out of 13 Board of Directors' meetings Attended 12 out of 12 Board of Statutory Auditors' meetings |

|||

| Koichi Tsuji | Contribute to maintaining and improving the Company's compliance, monitor management, and provide advice based on his insight and experience as certified public accountant | Appointed in June 2023 | |||

| Non-Japanese Experts | Thomas M. Connelly, Jr. *2 | Provide advice to improve corporate value based on his abundance of corporate and business management experience on a global level | ✔ | - | |

| Gerardus Johannes Wijers *3 | Provide advice to management based on his abundant global corporate experience and his high level of insight pertaining to the economy and business management | ✔*1 | - |

- *1Member since fiscal 2023

- *2Former CEO of the American Chemical Society

- *3SEO Economisch Onderzoek, Chairman-Supervisory Board

(As of September 2023)

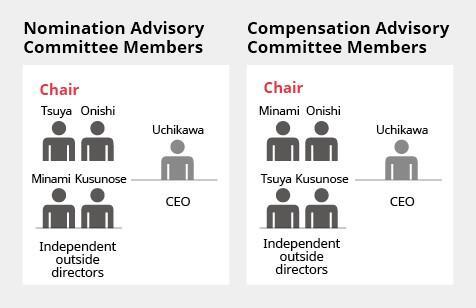

Nomination Advisory Committee / Compensation Advisory Committee

The Nomination Advisory Committee and the Compensation Advisory Committee are established as consultative bodies of the Board of Directors to further enhance the transparency concerning the appointment of directors and officers. Each committee deliberates on the following matters and makes recommendations to the Board of Directors.

Nomination Advisory Committee

- Deliberation on CEO succession and recommendation of successor

- Selection and dismissal of candidates for representative directors

- Selection and dismissal of candidates for directors (including Chairperson)

- Selection and dismissal of candidates for statutory auditors

- Promotion, demotion, selection, and dismissal of internal directors and senior management

- Deliberation on matters concerning the criteria for independence of outside directors and outside statutory auditors

- Selection of candidates for CEO and review of the CEO's plan and progress thereof for developing potential successors

Compensation Advisory Committee

- Deliberation on matters concerning the compensation system of corporate officers of the Teijin Group

- Deliberation on matters concerning the level of compensation of corporate officers of the Teijin Group

- Evaluation on the performance of and deliberation on matters concerning the amount of compensation for internal directors (including the CEO) and senior management

(As of September 2023)

Four independent outside directors, the Chairperson of the Board of Directors (currently, the Chairperson's post is vacant), and the CEO participate as members of the Company's advisory committees, which are chaired by an independent outside director. For matters concerning the current CEO, in principle, the CEO leaves the room and does not participate in the deliberations. For matters concerning the Chairperson, the Chairperson leaves the room and does not participate in the deliberations.

Board of Advisory Committees' Meetings in Fiscal 2022

Number of Meetings Held

Nomination Advisory Committee: 5

Compensation Advisory Committee: 9

Main Agenda Items and Discussion Topics

| Nomination Advisory Committee |

|

|---|---|

| Compensation Advisory Committee |

|

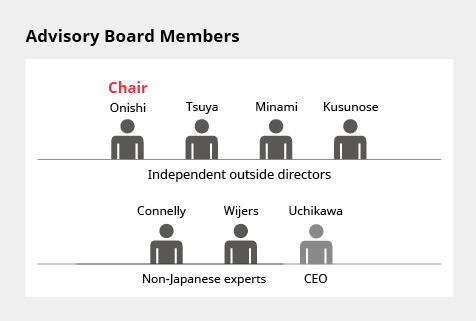

Advisory Board

(As of September 2023)

The Advisory Board, comprising both Japanese and non-Japanese experts, has been established to provide advice to management in general from a broad and long-term perspective, and operates as a consultative body to the Board of Directors. The Advisory Board is made up of five to seven outside advisors (currently, it comprises four independent outside directors and two non-Japanese experts) as well as the Chairperson of the Board of Directors (currently, the Chairperson's post is vacant) and the CEO. The Advisory Board is chaired by the independent outside director who chairs the Board of Directors.

The Advisory Board discusses the following matters and provides relevant advice to the Board of Directors.

- (i)Items pertaining to the Company's business planning and strategic direction (including long-term and medium-term business plans)

- (ii)Items related to corporate governance, sustainability, and corporate ethics, etc.

- (iii)Items concerning the Company's performance

- (iv)Items pertaining to internal/external politics, the economy, and laws and legislation

- (v)Other items related to overall business management

Group Strategy Committee / Group Management Committee

Important matters related to business execution of the Company and the Teijin Group, for which authority has been delegated by the Board of Directors, are decided by the CEO through deliberation in the Group Strategy Committee, which meets at least twice a month in principle, and the Group Management Committee, which meets once a month in principle. The Group Strategy Committee consists of the CEO, chief officers, and other members designated by the CEO. The CEO convenes and chairs the committee meetings. The Group Management Committee comprises the CEO, chief officers, general managers of the Company's business units, and others designated by the CEO.

The CEO convenes and chairs the meetings of this committee as well. In addition to these members, the committees are also attended by the internal full-time statutory auditors.

Officer Compensation

Based on the viewpoint of corporate governance and the stakeholders and to further enhance corporate value creation based on strengthening management from a medium- to long-term perspective, including in terms of sustainability and environmental, social, and governance (ESG) initiatives, the Company introduced "restricted stock" and "performance share units" systems. These systems were introduced with the aim of providing an incentive for directors to achieve the targets of the Company's management plans and to enhance corporate value over the medium to long term. As a result of introducing these systems, the ratio of share-based remuneration has increased. In addition, this revised officer compensation system has been applied to all corporate officers on a global basis in order to further strengthen the Group's management foundation.

Basic Policy on Compensation Systems

- The system should enhance awareness of contributing to medium- to long-term increases in earnings and corporate value.

- The system should be closely linked to the Company's performance and highly transparent and objective.

- The system should be primarily focused on sharing value with stakeholders and enhancing management's awareness of the interests of shareholders.

- The system should maintain sufficient compensation levels and content to act as incentives to secure high-quality management personnel.

Officer Compensation System

The compensation ratio for internal directors (excluding the Chairperson and Senior Advisors) is as follows.

| Position | Fixed compensation | Variable compensation | Total | ||

|---|---|---|---|---|---|

| Basic compensation (cash) | Restricted stock (shares) | Performance-linked compensation (cash) | Performance share units (shares) | ||

| President & Representative Director, CEO | 45% | 10% | 20% | 25% | 100% |

| Other directors | 50% | 10% | 25% | 15% | 100% |

| Monetary compensation | Stock compensation | |

|---|---|---|

| Fixed compensation | Basic compensation A fixed amount is paid in the form of basic compensation to directors according to their position/job grade. |

Restricted stock A fixed number of restricted shares are provided to directors according to their position/job grade. |

| Variable compensation | Performance-linked compensation With a view toward the steady implementation of the Reforms for Profitability Improvement initiative, performance-linked compensation is paid to directors in an amount based on individual performance assessments and the level of achievement of key management indicators, including 1. Consolidated ROE , 2. Operating income, and non-financial indicators (3. Group CO2 emissions, 4. Rate of lost-worktime injuries, 5. Diversity and inclusion, and 6. Degree of employee satisfaction). |

Performance share units In order to enhance corporate value and shareholder value over the medium to long term, restricted shares are provided to directors in the event targets are achieved based on the indicators of 1. Consolidated ROE, 2. Consolidated ROIC based on operating income, and 3. Total shareholder return. |

- Note:The Chairperson, Senior Advisors, outside directors, and statutory auditors are not eligible to receive performance-linked compensation, restricted stock (shares), and performance share units, and are only paid basic compensation.

(As of September 2023)

Officer Compensation Amounts (Fiscal 2022)

| Position | Total compensation amount (millions of yen) | Total compensation amount by type (millions of yen) | Number of officers receiving compensation | |||

|---|---|---|---|---|---|---|

| Basic compensation | Performance-linked compensation | Restricted stock | Performance share units | |||

| Directors (excluding outside directors) | 345 | 292 | 14 | 39 | - | 6 |

| Statutory auditors (excluding outside statutory auditors) | 75 | 75 | - | - | - | 2 |

| Outside directors | 72 | 72 | - | - | - | 5 |

| Outside statutory auditors | 41 | 41 | - | - | - | 3 |

- Note:Since the targets for the fiscal year under review were not achieved, the portion of performance share unit compensation for directors (excluding outside directors) corresponding with business execution was not granted.

Total Risk Management

In addition to enhancing shareholder value, the mission of the Teijin Group is to conduct sustainable business activities that deliver value to its shareholders and all of its other stakeholders. In light of this mission, the Group strives to comprehensively and effectively assess, evaluate, and manage the various risks that could threaten the realization of its mission. By doing so, the Group adopts an organizational and systematic approach to risk management that leverages its Groupwide management capabilities. Specifically, the Group has in place a Total Risk Management (TRM) system targeting both strategic risks--which relate to such factors as the formulation of management strategies and plans, the implementation of strategic actions, and the determination of individual investment projects--and operational risks, which involve various adverse events that can negatively affect the Group's operations, in order to address the various risks that impact the sustainable growth of the Group.

Established in fiscal 2003, the TRM Committee, chaired by the CEO, serves under the Board of Directors. The Board of Directors deliberates and decides the basic policy and annual plan related to TRM proposed by the TRM Committee. At the same time, the Board of Directors formulates systems for managing important risks and ensuring business continuity. Also, the statutory auditors conduct audits to check whether the Board of Directors is appropriately handling policy decisions, overseeing, and monitoring with regard to TRM. The CEO is in charge of assessing strategic risks and provides this assessment as valuable information to the decision-making process of the Board of Directors and other bodies. The Chief Sustainability Officer (CSO) is in charge of overall Groupwide operational risks, including risks facing overseas Group companies, and works on a cross-organizational level to ascertain and confirm the status of risk management in each business unit and at each Group company. At the same time, we promote necessary efforts to address risks that require consistent response policies on a Groupwide basis. In addition, the Group is working to clarify how risks and opportunities presented by trends in the macroeconomic environment relate to its materiality and follows up on such risks accordingly.