Business Risks

In addition to enhancing shareholder value, the mission of the Teijin Group is to conduct sustainable business activities that deliver value to its shareholders and all of its other stakeholders. In light of this mission, the Group strives to comprehensively and effectively assess, evaluate, and manage the various risks that could threaten the realization of its mission. By doing so, the Group adopts an organizational and systematic approach to risk management that leverages its Groupwide management capabilities. Specifically, the Group has in place a Total Risk Management (TRM) system targeting both strategic risks--which relate to such factors as the formulation of management strategies and plans, the implementation of strategic actions, and the determination of individual investment projects--and operational risks, which involve various adverse events that can negatively affect the Group's operations, in order to address the various risks that impact the sustainable growth of the Group.

Established in fiscal 2003, the TRM Committee, chaired by the CEO, serves under the Board of Directors. The Board of Directors deliberates and decides the basic policy and annual plan related to TRM proposed by the TRM Committee. At the same time, the Board of Directors formulates systems for managing important risks and ensuring business continuity. Also, the statutory auditors conduct audits to check whether the Board of Directors is appropriately handling policy decisions, overseeing, and monitoring with regard to TRM. The CEO is in charge of assessing strategic risks and provides this assessment as valuable information to the decision-making process of the Board of Directors and other bodies. The Chief Sustainability Officer (CSO) is in charge of overall Groupwide operational risks, including risks facing overseas Group companies, and works on a cross-organizational level to ascertain and confirm the status of risk management in each business unit and at each Group company.

At the same time, we promote necessary efforts to address risks that require consistent response policies on a Groupwide basis.

In addition, the Group is working to clarify how risks and opportunities presented by trends in the macroeconomic environment relate to its materiality and follows up on such risks accordingly.

Please note that the matters discussed in this report concerning the future are those evaluated by the Teijin Group as of March 31, 2023.

Responding to Risks Pertaining to the Reforms for Profitability Improvement Initiative

Risks are occurring much more frequently as the external operating environment continues to change at greater speed. To respond to these risks in a more resilient manner, we have been working to transform our management structure since fiscal 2023 to accelerate management decision-making and business execution. Specifically, we have centralized the business units under the direct control of the CEO in an effort to flatten our organizational layers. By doing so, we have been enhancing our head offices' ability to draft and monitor business strategies and plans. At the same time, we are making efforts to further delegate decision-making authority to the business units to strike a balance between swift business execution and risk management. We are also prioritizing management of risks pertaining to the Reforms for Profitability Improvement initiative as strategic risks.

Responding to Risks Related to the COVID-19 Pandemic

The COVID-19 pandemic's impact on the global economy has had a major effect on our performance in the Materials Business Field, for which automotive and aircraft applications serve as the main market. In particular, there was a significantly delayed recovery in demand for carbon fibers for aircraft. As part of our efforts to address this issue, we have been working to enhance production and operational efficiency by expanding into other applications for which demand is robust. We have also been striving to increase profitability by improving our sales mix. Furthermore, we have been promoting development geared toward the acquisition of large-scale programs for carbon fiber intermediate materials for aircraft, for which demand is expected to recover over the medium to long term, and engaging in ongoing efforts to rigorously monitor profitability. As a result of such initiatives, demand for aircraft has recovered and profitability has improved. In regard to the lockdowns and other policies in China following the country's zero-COVID policy, which started at the end of March 2022, we are closely monitoring the impact of supply chain disruptions and the suspension of operations at our manufacturing facilities and those of our customers that have resulted from this policy, as well as the situation concerning sluggish demand since the policy's implementation.

Response to Geopolitical Risks

With regard to rising geopolitical risks around the world, including the Ukraine situation, North Korea, and the circumstances surrounding Taiwan, we have set up a Groupwide emergency response structure and emergency evacuation program, and have been providing humanitarian aid. We have also been carrying out appropriate measures to respond to such risks after analyzing and evaluating their direct and indirect impacts on our operations.

Strategic Risks: Identification and Analysis, and Relevant Response Policies

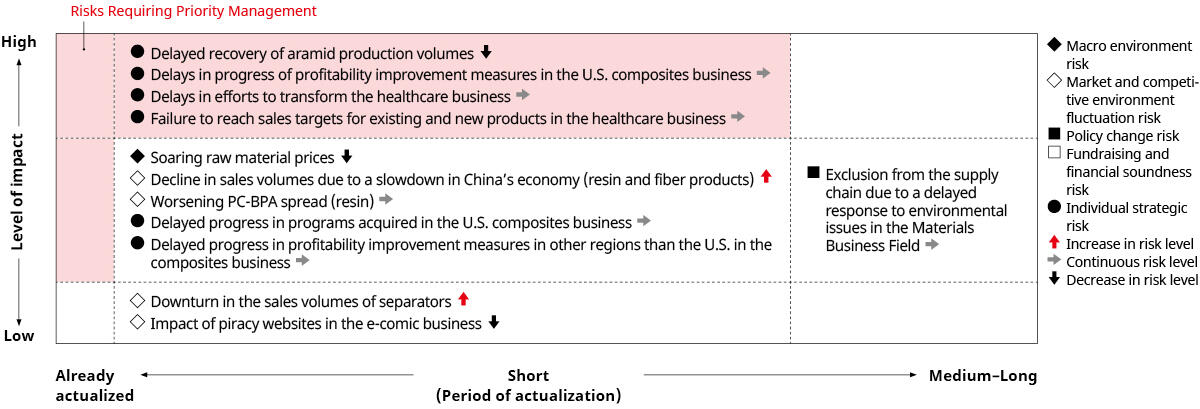

We have broken down strategic risks into five different categories: Macro environment risks, market and competitive environment fluctuation risks, policy change risks, fundraising and financial soundness risks, and individual strategic risks. We have also analyzed specific and recent strategic risks, including those already actualizing in our business strategies, from the perspectives of level of impact, period of actualization, and fluctuation trends, by making use of a strategic risk map. Based on this analysis, we have established response policies in accordance with the level of urgency and impact and have swiftly begun to put these policies into action. In fiscal 2023, in particular, we identified areas of our risk management structure that need to be improved, taking into account a review of our risk management activities in the previous fiscal year. In addition, we have been working to further enhance our monitoring of risks that require prioritized management, including those pertaining to progress of the Reforms for Profitability Improvement initiative, and to strengthen our response for when such risks actualize.

Strategic Risks: Overall Risks and Basic Response Policies

| Risk category | Risk summary | Basic response policy |

|---|---|---|

| Macro environment risks |

|

We are taking steps to identify and assess primarily trends that could have a substantial impact on our performance and financial position. We are also working to reduce risks through a broad range of measures. For example, we are stabilizing raw material and fuel prices by securing appropriate inventory levels, entering into long-term purchasing contracts, and implementing appropriate selling price measures. For exchange rates, we are also utilizing foreign exchange forward contracts and procuring funds for overseas investment in local currencies. In terms of interest rates, we are pursuing long-term debt with fixed interest rates. |

| Market and competitive environment fluctuation risks |

|

To respond to policy change risk such as tightening environmental regulations and the emergence of protectionism around the globe, as well as market and competitive environment fluctuation risk, we are creating contingency plans in advance for individual businesses affected by such risks. At the same time, we are promoting ongoing monitoring activities, including detecting signs of risk occurrences, and ensuring we are prepared to swiftly respond to risks by revising our strategies and other measures. In addition, we are working to collect relevant information on economic security to promptly ascertain a potential crisis. |

| Policy change risks |

|

|

| Fundraising and financial soundness risks |

|

In addition to regular monitoring of the ratio of net interest-bearing debt to EBITDA, the shareholders' equity ratio, and the debt-to-equity ratio, we are assessing the scale for risk of loss on shareholders' equity through the continuous monitoring of assets with impairment concerns and deferred tax assets. When procuring funds, we examine optimal procurement methods in consideration of financial soundness and based on demand for large-scale funding over the near to medium term as well as the risk of loss on shareholders' equity. Furthermore, we are making thorough efforts to streamline assets through working capital management and the reduction of cross-shareholdings. |

| Individual strategic risks (including those pertaining to the Reforms for Profitability Improvement initiative) |

|

By determining KPIs for the progress we are making toward are plans and monitoring them accordingly, we are controlling various factors that would cause us to deviate from our plans. For large-scale strategic investments aimed at business creation and expansion, we are thoroughly ascertaining the situation surrounding such investments in consideration of the operating environment and focusing on the implementation of action plans to address individual issues. |

Operational Risks: Identification and Analysis, and Relevant Response Policies

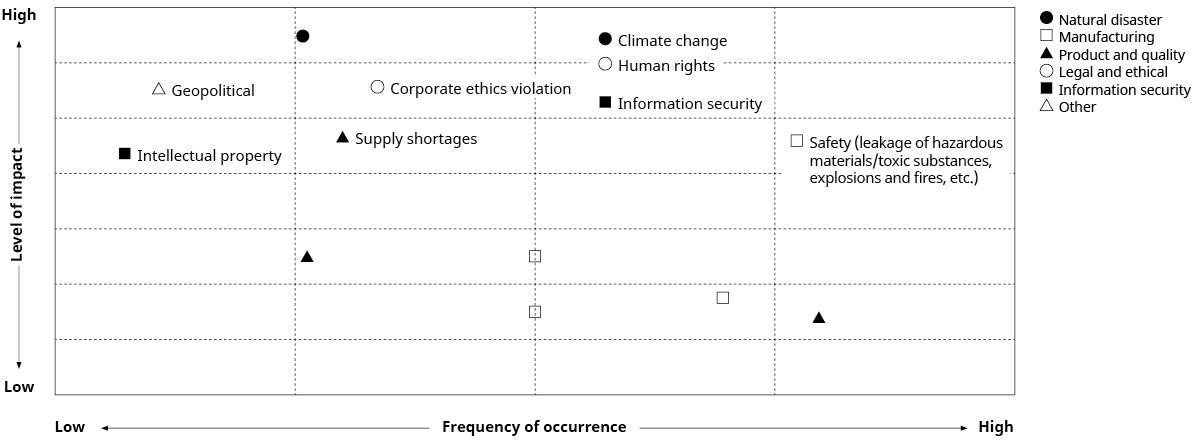

We have broken down operational risks into six categories: Natural disaster, manufacturing, product and quality, legal and ethical, information security, and others. We have also identified and analyzed recent operational risks based on their level of impact and frequency of occurrence. By doing so, we have positioned five categories of Groupwide risks as "serious Group risks" and are formulating policies to respond to these categories, which include: i) Climate change risks; ii) Human rights-related risks; iii) Information security risks; iv) Geopolitical risks; and v) Safety risks.

Operational Risks: Specific Initiatives toward Serious Group Risks

| Risk category | Risk summary | Relevant material issues* | Response measures | Frequency of occurrence | Level of impact |

|---|---|---|---|---|---|

| Climate change risks |

|

A | We assess and manage climate change-related risks impacting each of our businesses in a comprehensive and systematic manner. We also work to enhance climate change risk identification and strengthen risk management PDCA cycles in each business. Additionally, risks impacting specific businesses that qualify as strategic risks are responded to as such within our efforts to manage strategic risks. | Medium-High | High |

| Human rights-related risks |

|

E | We assess and systematically manage human rights-related risks that could lead to departures of personnel. We also use consistent policies and guidelines to assess and monitor not only our business partners' adherence to laws and regulations but also their response to soft laws. In this way, we are strengthening the management of supplier compliance. | Medium-High | High |

| Information security risks |

|

E | We respond to risks related to the management and transfer of information assets and trade secrets and risks related to cyberattacks based on the perspective of physical threats and vulnerabilities, technological threats and vulnerabilities, and human threats and vulnerabilities. To that end, we have set up an information security governance structure and established various processes and are promoting specific initiatives through the Group Information Security Subcommittee. | Medium-High | High |

| Geopolitical risks |

|

E | We have been working to establish emergency response structures during normal times to enable the provision of support to our business locations across the globe, should any one of them become involved in a conflict. We are also preparing a global crisis management structure and are implementing relevant training and drills. | Low | High |

| Safety risks |

|

E | We strive to steadily entrench the safety standards of the Teijin Group at all of our locations. We also provide Companywide support at locations where accidents frequently occur. | High | High |

- *Materiality: A = Climate change mitigation and adaptation; B = Achievement of a circular economy; C = Safety and security of people and local communities;

D = Realization of healthy and comfortable living for people; E = Further strengthening of our sustainable management base