For Investors

Medium-Term Management Plan

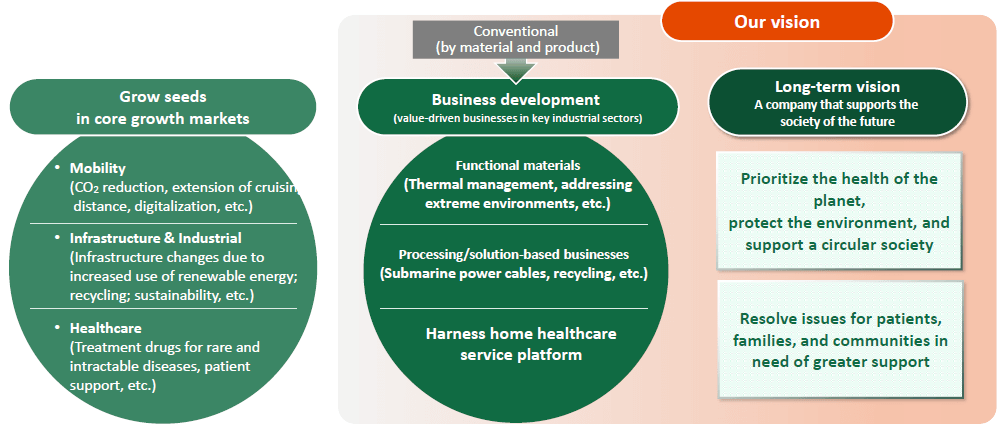

In the medium- to long-term, keenly being aware of the Teijin Group's issues, we commit ourselves to complete profitability improvement measures, narrow down the businesses, and strengthen global management basis that supports business portfolio reform so as to be reborn into new Teijin. Aiming to be "a company that supports the society of the future," we will transform its business development from the conventional materials-only business to a value-added business, and respond to complex social issues by refining our ability to combine different technologies and functions and to align with our customers' needs.

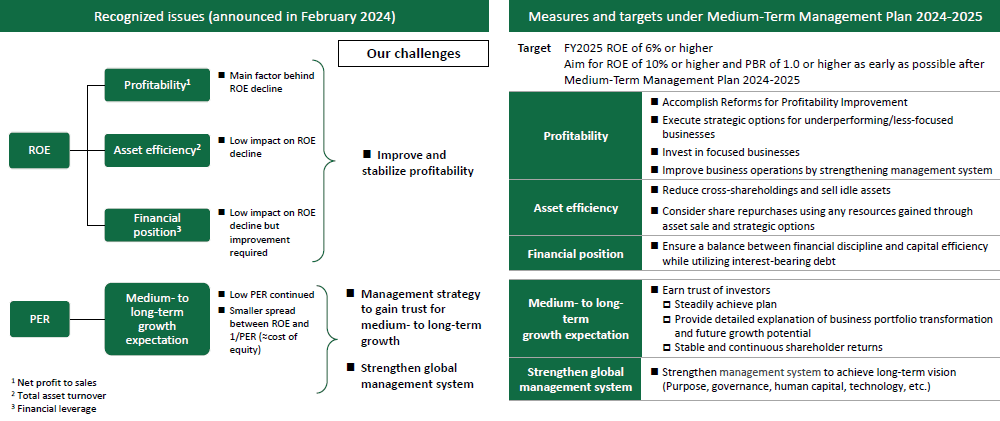

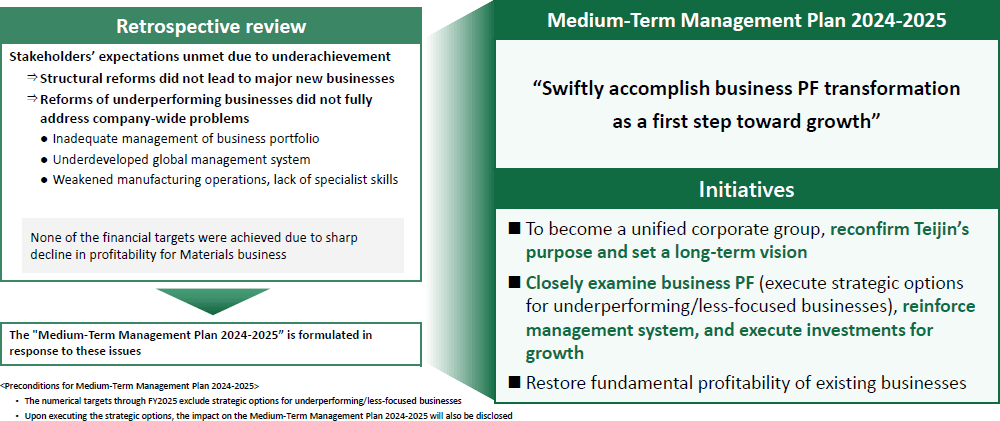

Summary of Medium-Term Management Plan 2024-2025

- In view of our past issues, we will make a fresh start by strengthening our global management system to support business portfolio (PF) transformation. The Medium-Term Management Plan 2024-2025 is the first step

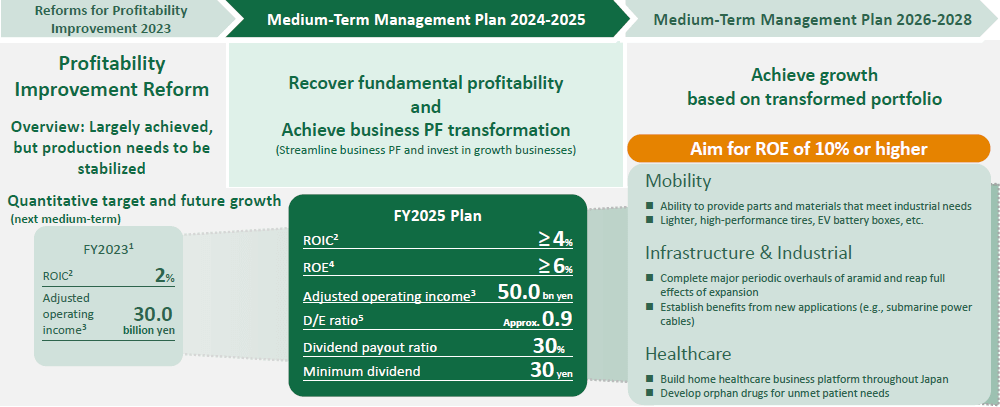

Transformation process

- Under the current Medium-Term Management Plan, aim to achieve adjusted operating income of 50.0 billion yen

(after tax adjusted operating income ROIC 4% or higher, ROE 6% or higher) - Under the next medium-term plan, aim for ROE of 10% or higher

Strategy for Growth and Capital Allocation

To be a company that supports the society of the future

- Aim for growth in key industrial sectors to solve social issues

- Transform in to value driven business in the medium- to long-term

- Respond to increasingly complex social issues by combining different technologies and functions

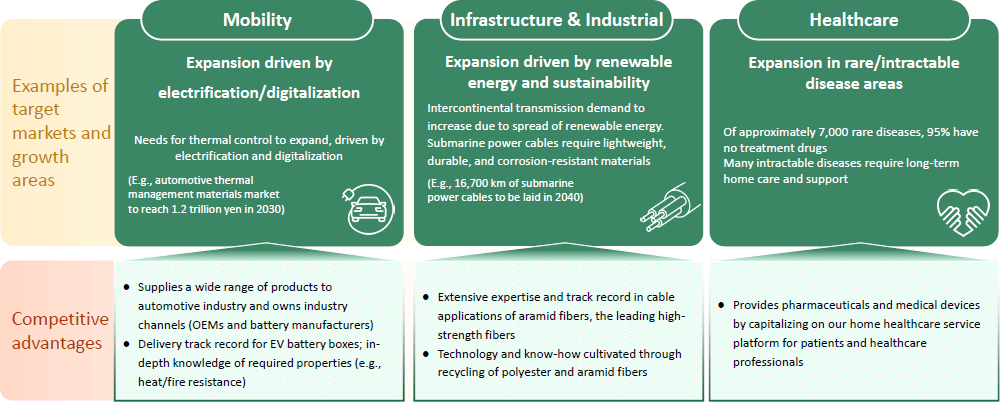

Basic strategy for growth investment

- To build a new competitive business portfolio that capitalizes on growing markets and Teijin's unique features, we will allocate our resources primarily to the mobility, infrastructure & industrial, and healthcare fields

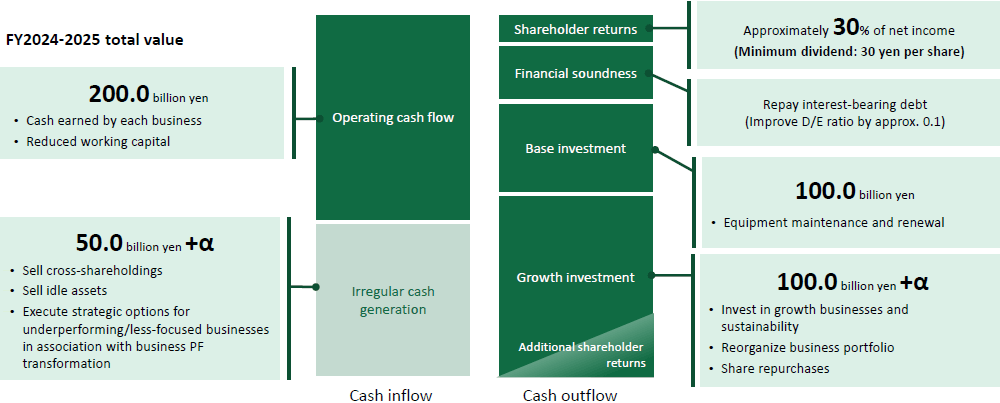

Capital allocation and shareholders returns policy (FY2024-2025)

- Strengthen ability to generate cash by improving profitability and allocate the cash for base investment and dividends on a priority basis

- As for cash generated from the sale of cross shareholdings/idle assets and the execution of strategic options for underperforming and less focused businesses, allocate it on a priority basis for growth investment and additional shareholder returns (including share repurchases)

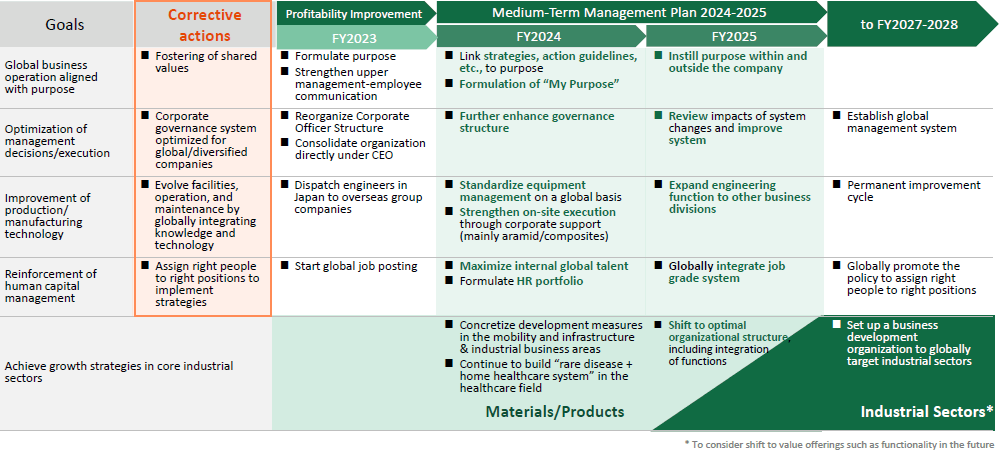

Enhancement of Management System

Roadmap to global management system enhancement

- Timed with portfolio transformation, enhance global management system and executional capabilities around our purpose

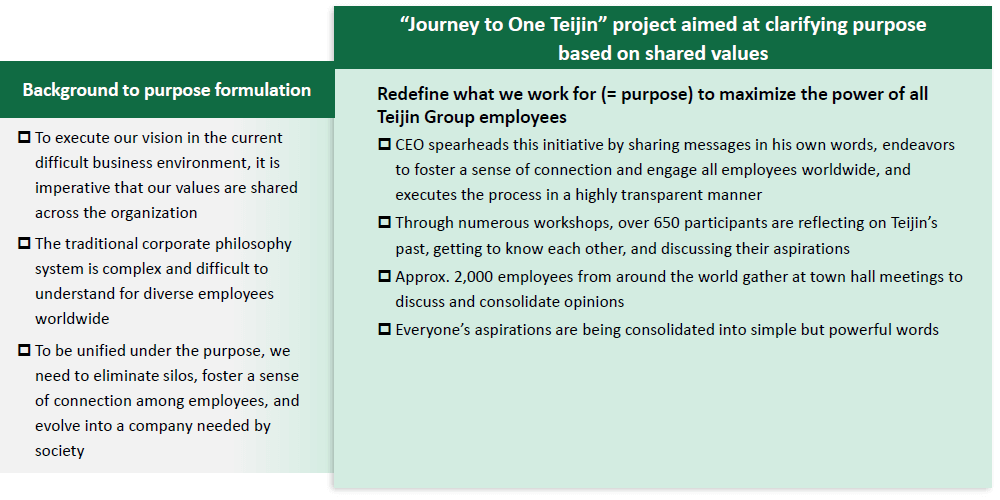

Purpose formulation project

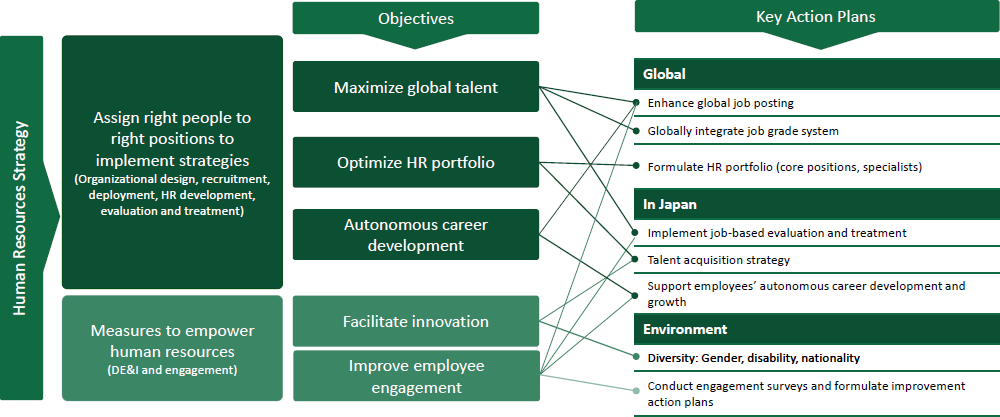

Human capital strategy

- Formulate HR strategies based on medium-term management plan and purpose/corporate philosophy

Maximize internal global talent - Set key action plans based on HR strategy of assigning right people to right positions and measures to empower them

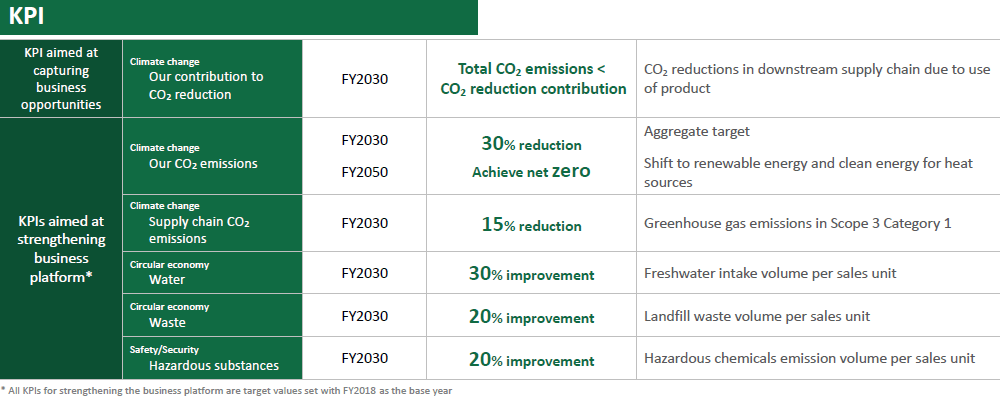

Sustainability major KPIs

- Prioritize internal sustainability efforts by degree of impact

- Continue efforts to achieve targets based on KPIs established for each priority issue

- Develop new KPIs for capturing business opportunities on a pilot basis, including KPIs related to carbon footprint, circular econom, and health/comfort

Initiatives to Improve PBR

- Based on analysis announced in February 2024, set/disclose PBR improvement measures/targets under Medium-Term Management Plan 2024-2025

- Steadily carry out plan for speedy improvement of PBR