Summary of Corporate Governance

Basic Concept

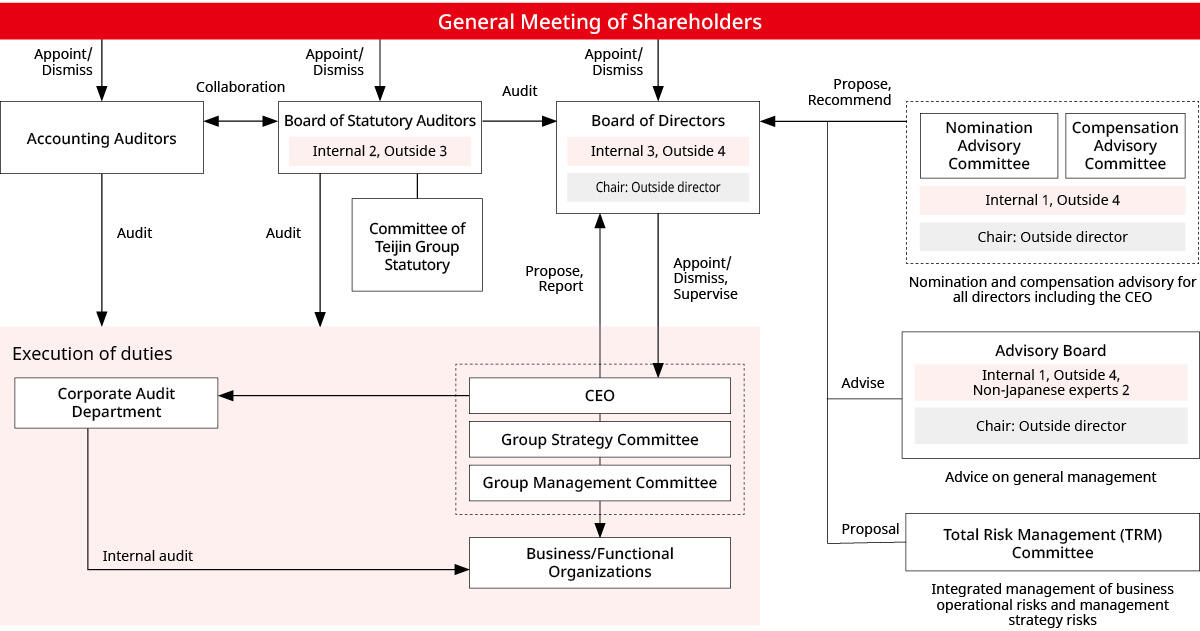

In accordance with the basic mission of the Teijin Group to continually increase its corporate value,the Group is working to strengthen corporate governance to fulfill its responsibilities to variousstakeholders. The Group is striving to establish and strengthen an effective corporate governance system based on the principles of improving transparency, ensuring fairness, speeding up decisionmaking, and ensuring the objectivity of monitoring and supervision through a Board of Directors and Corporate Officer System in which at least half of the members are independent outside directors, an Audit & Supervisory Committee in which the majority of members are Independent outside directors, and a Nomination Advisory Committee and Compensation Advisory Committee in which the majority of members are independent outside directors. The Group has also formulated and published the Teijin Group Corporate Governance Guide, which sets forth guidelines for corporate governance.

Status of Compliance with the Japan's Corporate Governance Code

The Company complies all Principles of the Corporate Governance Code. Please refer to Corporate Governance Report for details.

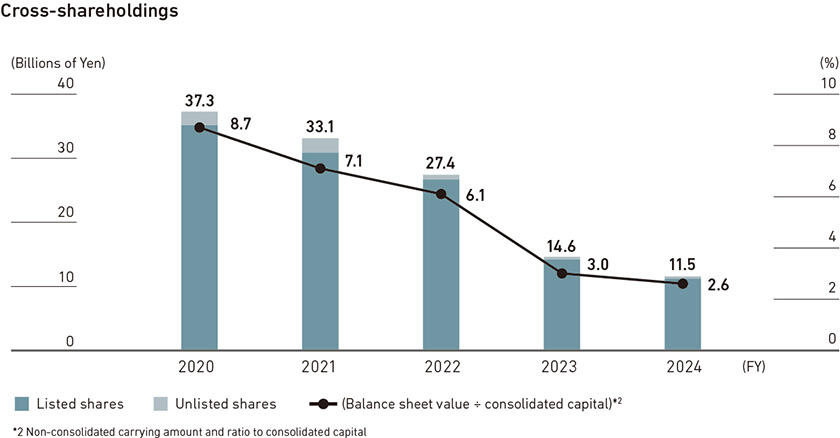

Cross-Shareholdings

(1) Basic Policy Concerning Cross-Shareholdings

The Company holds shares of issuing companies that it has determined to be instrumental in increasing its corporate value over the medium- to long- term, with the objective of maintaining and strengthening transactions, promoting business alliances with them and so on.

Each year, the Board of Directors reviews whether or not it is appropriate to hold shares based on an examination of the holding purpose and rationality for each individual stock from a medium- to long-term perspective.

In these reviews, the Board of Directors takes into account a comprehensive range of factors, including, without limitation, significance from a management strategy standpoint and business relationships, in addition to comparing dividends, transaction amounts, and other quantitative impacts against the cost of capital.

Based on the results of these reviews, the Company proceeded with the sale of the shares deemed to have diminished significance. During FY2024, the Company sold all shares of two specific investment stocks and two deemed investment stocks (with one stock overlapping), as well as part of the shares of two specific investment stocks. The total sale value amounted to 5.5 billion yen, out of which 3.6 billion yen was from deemed investment stocks.

The Company will continue discussions with the companies the shares of which the Company currently holds, and in principle, will endeavor to sell all of the shares of the listed companies.

In addition, whenever the shareholders of cross-shareholdings indicate their intention, such as intention to dispose of their

shares of the Company, the Company handles the matter appropriately without interfering with disposal of such shares.

- *The selling price is the amount of the listed shares sold by the Company (non-consolidated basis)

(2) Standards for the Exercise of Voting Rights Related to Cross-Shareholdings

In exercising the voting rights related to the shares that the Company has decided to hold, the Company confirms each proposal from the perspective of its increasing corporate value and shareholder value of the issuing companies over the medium- to long- term and determines whether to vote for or against.

For proposals that may have a significant impact on the corporate value of the investee companies, the Company collects and examines information with particular attention paid.

Major Initiatives for Strengthening Governance

| 1999 |

|

|---|---|

| 2003 |

|

| 2012 |

|

| 2015 |

|

| 2021 |

|

| 2022 |

|

| 2023 |

|

| 2024 |

|

| 2025 |

|

Organization Structure: A Company with an Audit & Supervisory Committee

The Teijin Group has a policy of adopting the most appropriate corporate governance structure for achieving the Company's objectives and reviewing the structure as and when necessary in response to changes in social and legal environments. In accordance with this policy, in June 2025 we made the transition to a Company with an Audit & Supervisory Committee.

This shift will allow the Company to expand the delegation of authority from the Board of Directors to executive departments and speed up management-related decision-making. The Board of Directors will also strengthen debate on important management issues such as medium to longterm management strategies, and directors responsible for audits (Audit & Supervisory Committee Members) will get voting rights, in order to enhance the supervisory function of the Board of Directors.

(As of August 2025)

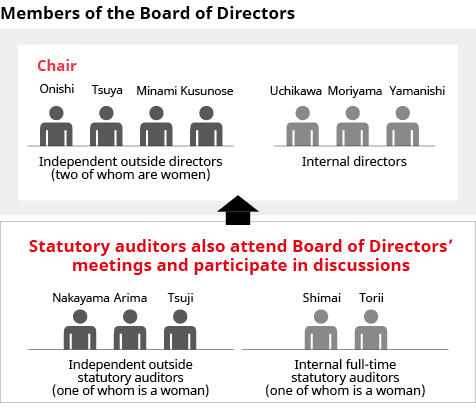

Board of Directors

The Board of Directors meets once a month, in principle, and deliberates and determines/approves important matters, such as Groupwide management policies and plans, as well as any other items required by laws, regulations and the Company's Articles of Incorporation. It also oversees Directors'performance of their duties. It sets the agenda items of Board of Directors meetings in accordance with the Regulations for the Board of Directors. Also, to expedite decision-making and clarify accountability of business execution, it properly delegates authority to Corporate Officers regarding important matters related to the business execution of the Teijin Group (individual short- and mediumterm plans and individual important matters with respect to each business and functional operation).

To expedite decision-making and clarify accountability of business execution, the Company's Articles of Incorporation set the maximum number of directors at 12, including five or less Directors who are Audit & Supervisory Committee Members, and the Company has introduced a corporate officer system that delegates broad authority to corporate officers. In principle, at least half of the Board members must be outside directors. The Company's Board of Directors is currently composed of 11 members (four women), including six outside directors who satisfy the requirements for Independent Directors specified by the Company. Six Directors who are not Audit & Advisory Committee Members, including three outside independent directors, and their terms of office are set at one year in the Articles of Incorporation. Five Directors who are Audit & Supervisory Committee Members, including three independent outside directors, and their terms of office are set at two years in the Articles of Incorporation.

Board of Directors' Meetings in FY 2024

Number of Meetings Held

14

Main Topics and Matters Deliberated

| Management/Business strategy |

|

|---|---|

| Corporate governance |

|

| Earnings/IR/Shareholders' meeting |

|

| Appointment and compensation of directors and officers |

|

Reasons for Selecting Skill Items

In accordance with medium-term management plan and management issues, a skills matrix based on "Reasons for Selecting Skills" was formulated. The "Skills Expected of Directors and Audit & Supervisory Committee Members in Fulfilling Their Roles and Responsibilities" are defined from the various kinds of knowledge, experience, and abilities possessed by Board members, with the aim of ensuring that the Board of Directors and Audit & Supervisory Committee have a good overall balance.

We are also working to increase gender and other diversity. With four female directors (Reiko Kusunose, Tomoko Torii, Tamie Minami, and Yaeko Takeoka), women now make up 36% of the Board of Directors. Tamie Minami is a foreign national.

| Category | Skill items | Reasons for selecting skill items |

|---|---|---|

| Management/Reform | Management of a (listed) company | It is important to identify risks and opportunities in managing listed companies in light of the business environment, make proper decisions from an overall perspective to improve corporate value, and supervise accordingly. |

| Restructuring of business/Internal reform | In order to implement portfolio reforms, we believe it is useful to have experience and knowledge of leading change management, such as business restructuring and internal reforms. | |

| Business | Business of the Company/Related fields | We believe it is useful to have knowledge in relevant fields when making important decisions related to the business and supervising the business while taking appropriate risk. |

| Function/Foundation | Production/Technology/Quality/Intellectual property/DX | We believe initiatives related to production innovation, quality management and reliability assurance, research and development, intellectual property and DX will become increasingly important as the foundation of competitiveness and profitability improvement. |

| Management of a global organization | We believe knowledge in management of a global organization, which involves different values and complexities, will become useful in maximizing organizational abilities and managing risks. | |

| Human capital/DE&I | As initiatives to transform corporate culture through the promotion of the Teijin Group's purpose and initiatives related to human capital to increase the effectiveness of management strategies, we believe it is essential to "ensure that the right people are assigned to the right positions in order to put into practice the strategies" and implement "measures to ensure that human resources can demonstrate their capabilities fully," in order to increase the corporate value. | |

| Finance/Accounting/IR | We believe financial strategy, capital policy and communication with capital markets are important in order to build a strong financial foundation that supports portfolio reforms and sustainable growth. | |

| Risk management/Legal affairs | In order to maintain and increase the corporate value, we believe it is essential to appropriately address risks that are becoming more complex and sophisticated by gathering and analyzing information. | |

| Sustainability | We believe it is important to pursue the enhancement of corporate value from the perspective of sustainability, based on the Teijin Group's purpose of "Pioneering solutions together for a healthy planet." |

Skill Matrix

Board of Directors

| Corporate Officer | Indepnendent Outside Director | ||||||

|---|---|---|---|---|---|---|---|

| Akimoto Uchikawa |

Naohiko Moriyama |

Yuji Nakahara |

Masaaki Tsuya |

Reiko Kusunose |

Toichi Maeda |

||

| Management/ Reform |

Management of a (listed) company |

● | ● | ● | |||

| Restructuring of business/ Internal reforms |

● | ● | ● | ● | ● | ● | |

| Business | Business of the Company/ Related fields |

● Materials |

● Healthcare |

● Infrastructure/ Material |

● Mobility |

● Mobility/ Industrial |

● Infrastructure/ Industrial |

| Functions/ Fundation |

Production/Technology/ Quality/IP/DX |

● | ● | ● | ● | ||

| Management of global organizations |

● | ● | ● | ● | ● | ||

| Human capital/DE&I | ● | ||||||

| Finances/Accounting/IR | ● | ● | |||||

| Risk management/Legal affairs | ● | ● | |||||

| Sustainability | ● | ● | ● | ● | |||

- *This table lists skills that members are expected to contribute in fulfilling their roles and responsibilities on the Board of Directors and the Audit&Supervisory Committee. It does not list all of their skills. Functions/Foundation show around two items.

Board of Directors (Audit & Supervisory Committee Members)

| Director/Full-time Audit & Supervisory Committee member | Independent Outside Director/ Audit & Supervisory Committee member |

|||||

|---|---|---|---|---|---|---|

| Masanori Shimai |

Tomoko Torii |

Koichi Tsuji |

Tamie Minami |

Yaeko Takeoka |

||

| Management/ Reform |

Management of a (listed) company |

|||||

| Restructuring of business/ Internal reforms |

● | |||||

| Business | Business of the Company/ Related fields |

● Materials |

● Healthcare |

● Infrastructure/ Industrial |

● Healthcare |

● Mobility/ Materials |

| Functions/ Fundation |

Production/Technology/ Quality/IP/DX |

● | ● | |||

| Management of global organizations |

● | ● | ||||

| Human capital/DE&I | ● | ● | ||||

| Finances/Accounting/IR | ● | ● | ||||

| Risk management/Legal affairs | ● | ● | ||||

| Sustainability | ||||||

- *This table lists skills that members are expected to contribute in fulfilling their roles and responsibilities on the Board of Directors and the Audit&Supervisory Committee. It does not list all of their skills. Functions/Foundation show around two items.

Status of Activities of Board of Directors

| Name | Position at the Company | Term of appointment | Expected role | Attendance at Board of Directors and Board of Statutory Auditors meetings (FY2024) | |

|---|---|---|---|---|---|

| Corporate Officer | Akimoto Uchikawa | President and CEO, Representative Directorof the Board |

4 years | Strong leadership for driving internal transformation and creating systems for enhancing execution capabilities, and initiatives for increasing profitability, business portfolio transformation, and strengthening management foundation (realization of Medium-Term Management Plan 2024-2025) | Board of Directors 14/14 times |

| Naohiko Moriyama | Senior Executive Officer, Representative Directorof the Board |

4 years | Leadership for transformation and creating and advancing growth strategies, strategic and proper addressing of various barriers and variable factors that arise when advancing a medium-term management plan | Board of Directors 14/14 times |

|

| Yuji Nakahara | Corporate Officer, Member of the Board |

ー | 経Formulating and pursuing a technology strategy based on the management strategy, and promoting growth strategy projects that will drive growth of the Company | Appointed in June 2025 | |

| Independent Outside Director |

Masaaki Tsuya | Director | 3 years | Experience as CEO and chairperson of a listed company, abundant business experience, decision-making based on exceptional insight, supervision of business execution, advice | Board of Directors 14/14 times |

| Reiko Kusunose | Director | 1 year | Experience in corporate transformation at companies that have undergone management integration and global organizational management, as well as decision-making, supervision of business execution, and advice to management based on broad knowledge and strong insight from a DE&I perspective | Board of Directors 9/9 times |

|

| Toichi Maeda | Director | ー | Supervise decision-making and business execution and advise on management based on personal experience in leading the evolution of business portfolios and ensuring efficient and effective corporate governance as president or chairperson of a listed company | Appointed in June 2025 | |

| Audit & Supervisory Committee member | Masanori Shimai | Director (Full-time Audit & Supervisory Committee member) | 6 years | Audit, supervise, and advise on decision-making and business execution, based on knowledge and experience of accounting and finance, and familiarity with business details | Board of Directors 14/14 times Board of Statutory Auditors 13/13 times |

| Tomoko Torii | Director (Full-time Audit & Supervisory Committee member) | 1 year | Audit, supervise, and advise on decision-making and business execution based on abundant work experience in the healthcare business, grounded in a solid knowledge of science and technology, and strong understanding of the Company's business activities and corporate culture | Board of Directors 9/9 times Board of Statutory Auditors 9/9 times |

|

| Independent Outside Audit & Supervisory Committee member |

Koichi Tsuji | Director (Audit & Supervisory Committee member) | 2 years | Audit, supervise, and advise on business execution based on deep insight gained from experience as a certified public accountant or corporate manager, as well as knowledge of risk | Board of Directors 14/14 times Board of Statutory Auditors 13/13 times |

| Tamie Minami | Director (Audit &Supervisory Committee member) | 2 years | Audit, supervise, and advise decision-making and business execution based on experience in healthcare and industrial materials business and as a manager in multiple geographical regions in a global company, and marketing | Board of Directors 14/14 times |

|

| Yaeko Takeoka | Director (Audit & Supervisory Committee member) | ー | Audit, supervise, and advise on decision-making and business execution based on deep insight into corporate legal affairs (e.g., intellectual property rights, compliance), a management perspective cultivated through extensive experience as an outside director, and knowledge of the Company's internal auditing system | Appointed in June 2025 |

Evaluation of Board of Directors' Effectiveness

To further ensure the effectiveness and enhance the functions of the Board of Directors, the effectiveness of the Board of Directors is comprehensively analyzed and evaluated every year.

Summary of Effectiveness Evaluation Results

The results of the Board of Directors Effectiveness Evaluation conducted in line with the above process found that there is no issue with the current corporate governance system and its implementation, and the Company's Board of Directors is functioning properly as a whole and ensuring effectiveness. It was also confirmed that a strong commitment by each Director and a relationship of mutual trust between Directors and Statutory Auditors that encourages open discussions are functioning as a strength that supports the effectiveness of the Company's Board of Directors.

Results of Measures Implemented in FY2024 to Further Enhance the Effectiveness of the Board of Directors

| Item | Specific content |

|---|---|

| Discussions on an ideal Board of Directors |

|

| Sorting out the meeting bodies |

|

| Sorting out matters to be discussed |

|

Status of Response to Issues Recognized in or Before FY2024

The Board deepened discussions on issues identified in and before FY2024 from a medium- to long-term perspective. To accelerate the formulation and execution of measures and policies by the CEO and other executive officers, the Board of Directors received reports on the implementation as appropriate, and confirmed the progress.

| Issues | Responses |

|---|---|

| Confirmation of the progress of medium- to long-term management plans and review of strategies as necessary |

|

| Measures related to sustainability strategy |

|

| Measures related to DX strategy |

|

| Measures related to human capital |

|

| Discussion on rationality of parent-subsidiary listing |

|

Issues Identified in the Effectiveness Evaluation Conducted in FY2024 and Future Initiatives

As a result of discussions held at Board of Directors' meetings and based on the evaluation of effectiveness conducted in FY2024, the Company identified and decided to promote efforts to address the following issues in FY2025. Efforts to improve the effectiveness of the Board of Directors and further strengthen corporate governance will continue.

| Issues | Responses |

|---|---|

| Deepening discussions on key issues |

|

| Reorganization and enhancement of function on fhe management executon system |

|

| Development of managerial human resources |

|

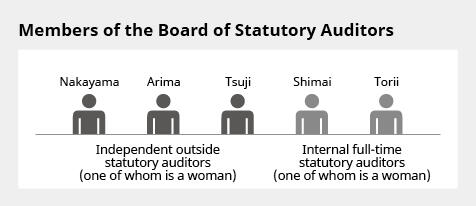

Audit & Supervisory Committee

In June 2025, the Company transitioned to a Company with an Audit & Supervisory Committee system.The Audit & Supervisory Committee consists of five members (including three women), of whom three-a majority-are outside directors who satisfy all the requirements of independent directors as stipulated by the Company. Audit & Supervisory Committee Members audit the performance of duties by Directors based on their expertise and experience in law, finance, and accounting, etc. Full-time Audit & Supervisory Committee Member Masanori Shimai and Outside Audit & Supervisory Committee Member Koichi Tsuji have ample knowledge of finance and accounting.

Furthermore, the Committee of Teijin Group Statutory Auditors, which comprises the members of the Company's Audit and Supervisory Committee, Full-time Statuary Auditors of group companies, personnel of the Audit & Supervisory Committee Office, the head of the Corporate Audit Department and other members, meets regularly to enhance the effectiveness of groupwide monitoring and audits.

Board of Statutory Auditors' Meetings in FY2024

In FY2024, the Statutory Auditors conducted audits focused on the following basic guidelines:(1) Focusing audits on the integrity of corporate activities; (2) Emphasizing preventive audits using a risk approach; (3) Strengthening understanding of the actual situation through on-site audits; and (4) Cooperating appropriately with Accounting Auditors and internal audits. The items listed in the table on the right were designated priority items.

Statutory Auditors attended meetings of the Board of Directors and other important meetings

(e.g., Group Strategy Committee Meetings, TRM Committee), reviewed important approval documents,

etc., and investigated the state of business and assets at head office and major factories. They also communicated and exchanged information with Board members and Statutory Auditors of subsidiaries, visited important subsidiaries, and received business reports from them as and when necessary.

Statutory Auditors also held informal discussions with the CEO and interviewed Directors and key executive officers, giving advice as and when necessary. Full-time Statutory Auditors received reports on the work of each head office staff department and exchanged opinions with them.

| Area of audit | Priority audit items |

|---|---|

| Governance |

|

| Corporate ethics/ compliance |

|

| Risk management associated with business operations |

|

| Risk management associated with management strategies |

|

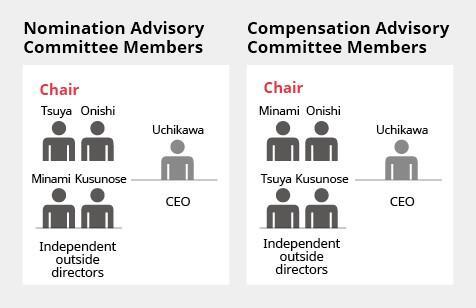

Nomination Advisory Committee/Compensation Advisory Committee

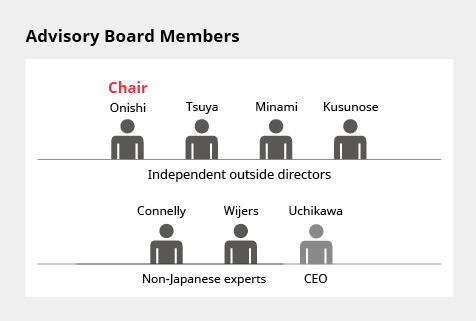

To enhance transparency in the appointment and compensation of Directors and Corporate Officers, the Company shall establish and operate the Nomination Advisory Committee and the Compensation Advisory Committee. Each of these committees deliberates on the following matters and formulates proposals and makes recommendations to the Board of Directors.

Both committees shall consist of all outside directors who are not Audit & Supervisory Committee Members, the Chairperson of the Board, and the CEO (in cases where the Chairperson is absent, all outside

directors who are not Audit & Supervisory Committee Members and the CEO). The Chair of each committee shall be selected from among outside directors who are not Audit & Supervisory Committee Members and shall preside over the respective committee meetings. The CEO, as an interested party, shall, in principle, not be included as a member of the decision-making body in matters concerning the CEO. Similarly, the Chairperson of the board, as an interested party, shall, in principle, not be included as a member of the decision-making body in matters concerning the Chairperson of the Board.

Matters to be Discussed in the Nomination Advisory Committee

- Succession of the CEO and nomination of a successor

- Appointment, retirement, and removal of the Representative Directors

- Election, retirement, and dismissal of Directors who are not Audit & Supervisory Committee Members(including the Chairperson of the Board)

- Matters concerning personnel changes of Executive Officers* (including appointment, retirement, removal, promotion, and demotion), and appointment or removal of Senior Advisors

- Matters concerning the criteria for independence of outside directors

- Selection of candidates to succeed the CEO and review of the succession development plan formulated by the CEO and its progress

- Matters concerning internal rules on Directors and Officers (excluding those related to compensation)

- Notes:Executive Officers: Corporate Executive Officers of the Teijin Group who serve as core members essential for deliberating on the overall business strategies of the Group

Matters to be Discussed in the Compensation Advisory Committee

- Matters concerning the compensation system for Directors, Executive Officers, and Senior Advisors (hereinafter collectively referred to as "Teijin Group Executives")

- Matters concerning the compensation levels of the Teijin Group Executives

- Matters concerning the performance evaluation and compensation amounts for Internal Directors (including the CEO) who are not Audit & Supervisory Committee Members, and for Executive Officers

- Matters concerning internal rules on Directors and Officers (compensation-related)

Board of Advisory Committees' Meetings in FY2024

Number of meetings held

Nomination Advisory Committee: 12

Compensation Advisory Committee: 14

Main Topics and Matters Deliberated

| Nomination Advisory Committee |

|

|---|---|

| Compensation Advisory Committee |

|

Group Strategy Committee/Group Management Committee

Important matters related to the business execution of the Company and the Teijin Group, for which authority has been delegated from the Board of Directors, are decided upon by the CEO through deliberation in the Group Strategy Committee, which meets at least twice a month in principle, and the Group Management Committee which meets once a month in principle.

The Group Strategy Committee consists of the CEO, executive officers, and other members designated by the CEO. The CEO convenes and chairs the committee meetings. The Group Management Committee consists of the CEO, executive officers, general managers of business units, and other members designated by the CEO. The CEO convenes and chairs the committee meetings. In addition to the members, both committees are also attended by the Full-time Audit & Supervisory Committee Members.

Executive Compensation

Teijin's policy for determining the individual compensation of its directors is reviewed annually for its appropriateness by the Compensation Advisory Committee, which consists of a majority of independent outside directors, and approved by resolution of the Board of Directors. These deliberations by the Compensation Advisory Committee take into consideration changes in the business environment as well as the opinions of shareholders and investors, while being informed by third-party organizations with extensive global experience and expertise. The term "Director" below refers to Directors who are not Audit & Supervisory Committee Members unless otherwise specified.

Basic Policy on Compensation Systems

- ⅰ.The system should motivate employees to achieve short-, medium-, and long-term management targets, as well as enhance awareness of contributing to medium- to long-term increases in profits and corporate value.

- ⅱ.The system should be closely linked to the Company's performance and highly transparent and objective.

- ⅲ.The system should be primarily focused on sharing value with stakeholders and enhancing shareholders-oriented management.

- iv.The system should maintain sufficient compensation levels and content to act as incentives to secure high-quality global management personnel.

Composition of Compensation for Directors

- ⅰ. The compensation for Inside Directors who concurrently serve as Corporate Officers is composed of performance-linked compensation (short-term incentive compensation), restricted stock compensation (medium- to long-term incentive compensation), and performance share units compensation (medium- to long-term incentive compensation) which are variable compensations, with the aim of providing an incentive to achieve short-term performance goals, achieve the medium-term management plan, and improve medium- to long-term corporate value, in addition to fixed basic compensation that is not linked with the performance of the Company.

For Inside Directors who do not concurrently serve as Corporate Officers, only basic compensation and performance-linked compensation, or only basic compensation is granted based on their appointed duties, and restricted stock compensation (medium- to long-term incentive compensation) and performance share units compensation (medium- to long-term incentive compensation) are not granted. - ⅱ. The compensation for outside directors is solely basic compensation that is not linked to the performance of the Company.

- ⅲ.The compensation for Directors who are Audit & Supervisory Committee Members is solely basic compensation based on their duties.

Composition Ratio of Executive Compensation

The compensation of Internal Directors who serve concurrently as executive officers is determined as follows.

Fixed Compensation

| Basic compensation | A fixed amount of basic compensation is paid to directors according to their position and job grade. |

|---|

Variable Compensation

| Performance-linked compensation | To restore core profitability and promote business portfolio transformation, the Company pays performance-linked compensation based on individual performance targets including adjusted operating income, ROIC based on after-tax adjusted operating income and non-financial indicators (safety). |

|---|---|

| Restricted stock compensation | Restricted stock and share units equivalent to a standard amount are awarded based on position and job grade. |

| Performance-linked stock compensation | To enhance corporate value and shareholder value over the medium- to long- term, restricted stock and performance share units are awarded according to the degree of attainment of targets, based on the financial indicators of ROE and TSR (total shareholder return), and sustainability, assessed in terms of non-financial indicators (environment, DE&I, employee engagement). The weighting of these indicators is 40% for ROE, 30% for TSR, and 30% for sustainability. |

- *A stock unit indicates that the Company will pay an amount equivalent to the price of one ordinary share per unit.

Officer Compensation Amounts (FY2024)

| Position | Total compensation amount (millions of yen) |

Total compensation amount by type (millions of yen) | Number of officers receiving compensation |

|||

|---|---|---|---|---|---|---|

| Basic compensation |

Performance- linked compensation |

Restricted stock compensation |

Performance- linked stock compensation |

|||

| Directors (excluding outside directors) |

365 | 189 | 75 | 38 | 62 | 4 |

| Outside directors | 75 | 75 | - | - | - | 5 |

| Statuary auditors (excluding outside statutory auditors) |

77 | 77 | - | - | - | 3 |

| Outside statutory auditors | 45 | 45 | - | - | - | 3 |